Over 2,700 Americans were surveyed

The average amount that Americans have saved for their retirement is $89,300, according to a new study.

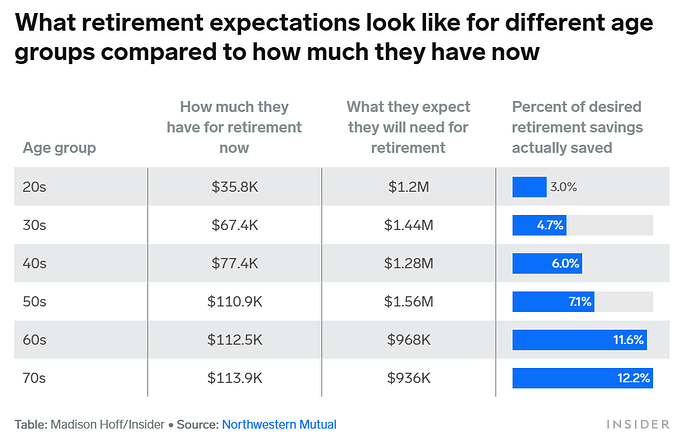

On average, those who gave a number believe they need about $1.27 million to retire comfortably, but the average respondent who shared their retirement savings had just $89,300 in the bank, in their 401(k), and other accounts.

That amounts to just 7% of that average goal.

Even qualified respondents in their 70s have just 12% of their goal saved, with an average $113,900 out of an expected need of $936,000.

The average amount those in their 20s think they are going to need for retirement was $1.2 million. Based on those who responded, this group have an average of $35,800, or 3% of that expectation, already saved.

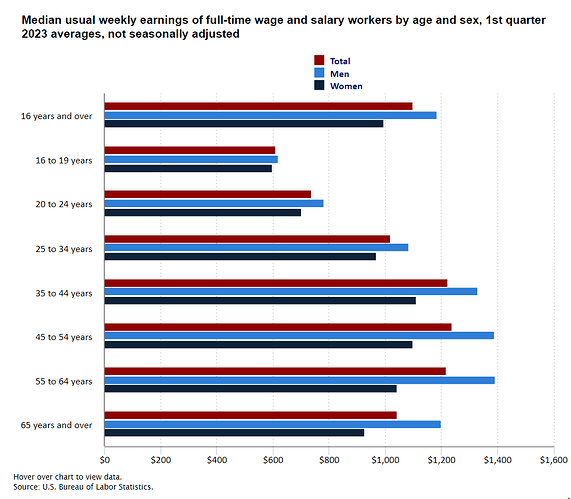

According to Bureau of Labor Statistics data, full-time workers aged 20 to 24 had lower median weekly earnings than their older peers, per data for the first quarter of 2023.

« To build wealth for the future, it’s important for people to invest strategically as part of a financial plan, » Menke said.

He added that his « advice for young adults is to start early, » figure out how much risk you’re willing to tolerate, diversify your investments and regularly stay on top of your portfolio.

Observation : Le montant moyen détenu est identique entre 50 et 70 ans : Environ $110,000