Faut pas se fier aux analystes

Alors

-

D’accord pour Legrand (je l’ai en portefeuille) : Ça monte bien (dans le sillage de Siemens et SU), mais le contexte de ralentissement dans l’immobilier incite à la prudence. Personnellement, je suis plus à l’aise avec les achats dans la zone 75-80. Allez, disons 85 max.

-

Bien sûr que Hermes va respirer un peu, vu le ralentissement global du luxe.

-

De manière générale, faut pas être grand clerc pour écrire qu’une valeur qui a monté… Redescendra

-

Qui plus est, il ne faut pas confondre contre-performance à CT et surperformance à LT.

[TL;DR : Toutes les actions descendent. La question, c’est : Lesquelles remontent ? ![]() ]

]

Bon j’ai craqué, j’suis rentré sur LVMH ![]()

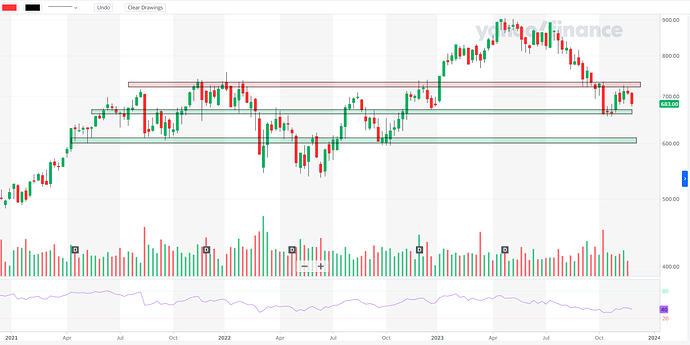

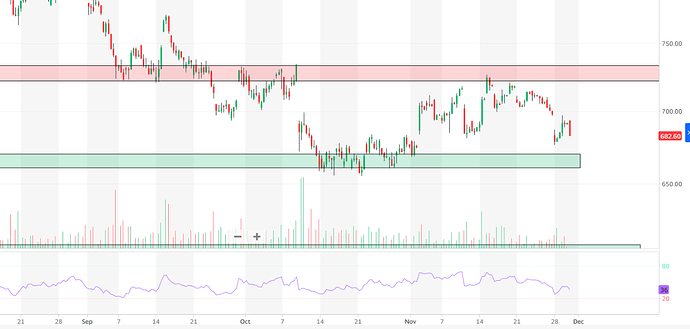

Du point de vue technique, on est coincé dans une zone entre 650 et 720

Plus récemment en zoomant on voit mieux la résistance autour des 720 et des volumes en baisse

Je vais encore patienter un peu perso, peut-être placer un ordre à 660

J’attends toujours 650 perso, mais je préférerais que mon ordre ne passe pas… qu’elle reprenne un peu sa marche en avant, j’ai assez accumulé dessus

Oui peut-être attendre encore, détachement le 4 décembre et ce matin j’ai lu que Stifel avait abaissé son objectif de cours, du coup ça va surement encore bouger d’ici semaine prochaine.

Bonjour la communauté, franchement cette action me donne le hoquet avec ces « up and down » jours après jours, qui ne semblent jamais s’arrêter…pénible.

+1 LVMH ![]()

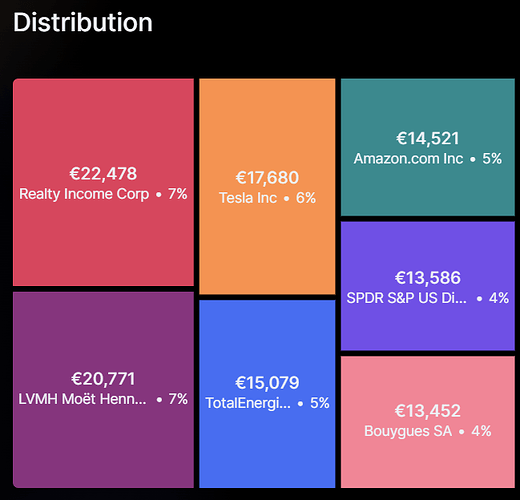

Allez je m’arrete jusqu’a la prochaine paie ![]() et je diversifie un peu plus mon PEA Portefeuille Portefeuille PEA de Adrien83560 • Moning 🚀

et je diversifie un peu plus mon PEA Portefeuille Portefeuille PEA de Adrien83560 • Moning 🚀

Sauf si LVMH continue de baisser, si c’est le cas je continuerais d’en accumuler jusqu’a atteindre les 40 actions

Bah, elle se balade ^^

Eh beh, ça en fait du LV ! Ta valeur préférée ?

Il vas falloir, tu me trahis là en sur pondérant LVMH par rapport à TTE, a un moment TTE était aussi ta première pose il me semble ![]()

Non $TTE n’a jamais ete la premiere ligne dans mon portefeuille ![]()

#4 aujourd’hui!

Coude a coude avec Realty Income

Effectivement, je n’avais vu que le PEA ! ![]()

Même vs Hermes par exemple ?

LVMH - A Luxury Conglomerate At A Reasonable Price

Name: LVMH Moet Hennessy Louis Vuitton

Ticker: MC.PA (Euronext Paris Eurolist)

Market Capitalization: €346 billion ($377 billion)

Sector: Consumer Discretionary

Industry: Luxury Goods

IPO (Initial Public Offering): October 1987

Return since 2000: 685% (CAGR: 9%)

LVMH is perhaps the most famous luxury business across the globe with brands like Louis Vuitton, Hennessy, Dior and Marc Jacobs in its portfolio. Since the luxury conglomerate was created back in 1987, LVMH has spent billions to successfully acquire and integrate the 75 prestigious brands that make up the company today. With a market cap north of $300 billion, LVMH is the second largest company in Europe and among the top 30 most valuable companies in the world.

(Source: https://twitter.com/tommydouziech/status/1597636758300229633/photo/1)

Founding Story

It is impossible to analyze LVMH without looking into Bernard Arnault, one of the world’s richest people and the man behind LVMH’s success. Arnault first entered the luxury industry in 1984 when he learned that Christian Dior’s parent company had gone bankrupt and that the French government was looking for a buyer. Arnault pounced on the opportunity, sold off most of the business and laid off a majority of the workers, and ultimately pocketed a few hundred million dollars in a few years.

This money came in handy a few years later when the large merger between Louis Vuitton and Möet-Hennessy went through in 1987 - and Arnault was able to acquire stock in the newly created LVMH through his relationship with Louis Vuitton CEO Henri Racamier.

Soon enough that relationship soured, and Arnault and Racamier were involved in a legal battle that ended with Racamier stepping down and Arnault taking over the throne at LVMH. Arnault himself downplayed the controversy: “It’s not a dispute over personalities. It’s a dispute over strategy.” However, Arnault was soon nicknamed “the wolf in the cashmere coat” for his ruthless business practices and ambitions to create the largest luxury-goods business in the world.Bernard Arnault is still the Chairman and CEO of LVMH.

Segments & Financials

Today, LVMH consists of 75 brands (called “maisons”) controlled by Bernard Arnault’s conglomerate. These brands earned close to €80 billion ($88 billion) in revenues with 68% gross margins and 18% net profit margins in FY22.

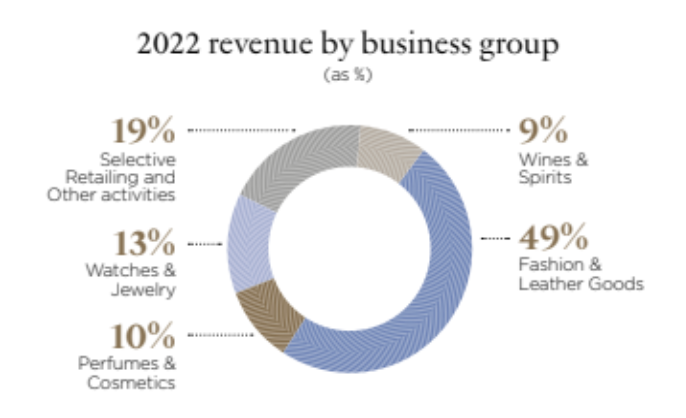

The 75 brands that make up LVMH are separated into 6 business groups that each include some of the most prestigious names in the luxury space:

Wines & Spirits: Moët & Chandon, Dom Pérignon, Hennessy

Fashion & Leather Goods: Louis Vuitton, Christian Dior, Celine, Marc Jacobs

Perfumes & Cosmetics: Christian Dior, Guerlain, Givenchy, Fenty Beauty by Rihanna

Watches & Jewelry: Tiffany, Bulgari, Chaumet, TAG Heuer, Hublot

Selective Retailing: Sephora

Other Activities: Groupe Les Echos (a leading French business and cultural news publication), Royal Van Lent **(**the builder of high-end yachts), Cheval Blanc and Belmond (a collection of luxury hotels).

The Fashion & Leather Goods group is by far the largest and most profitable group with €38.6 billion in revenue and 40.6% operating margins (compared to 26.6% for LVMH) in FY22. That means this group is responsible for close to half of LVMH’s total revenue. However, the geographical mix of the Fashion & Leather Goods group differs from the rest of the company; 36% of the revenue came from Asia excluding Japan in FY22. For comparison, the Wines & Spirits group had 20% of its revenue in the same market.

Emerging markets can be significantly more volatile because the consumer is more exposed to the economic cycle. If the economy in some of these countries (e.g. China, South Korea) take a turn for the worse, LVMH should expect to see slowing growth in this market as well.

Looking at the numbers, LVMH has a Stock Unlock Insights Score of 3.81. Management and analyst ratings are the main positives while financial health is the detractor of this score.

If we look further into the financial health score, LVMH is mainly punished for the fact that goodwill and intangibles account for a large % of total assets. This is usually seen among companies that focus on acquisitions (remember that goodwill is added to a company’s balance sheet if they pay more than the target’s book value in an acquisition).

In LVMH’s case, M&A is the bread and butter of Bernard Arnault’s empire. While acquisitions can be risky, particularly if a company overpays or fails to integrate the new business, LVMH has an exceptional track record. The decentralized model LVMH operates with is key because it allows the various groups to work independently and make rapid decisions when necessary. It also ensures that each brand maintains a close relationship with its customers without becoming too “corporate” when it is added to the LVMH conglomerate.

Because LVMH has been so successful with its M&A strategy, the company has been able to diversify its offerings and reach new customers which in turn has created incredible shareholder value since the 1987 merger.

Valuation

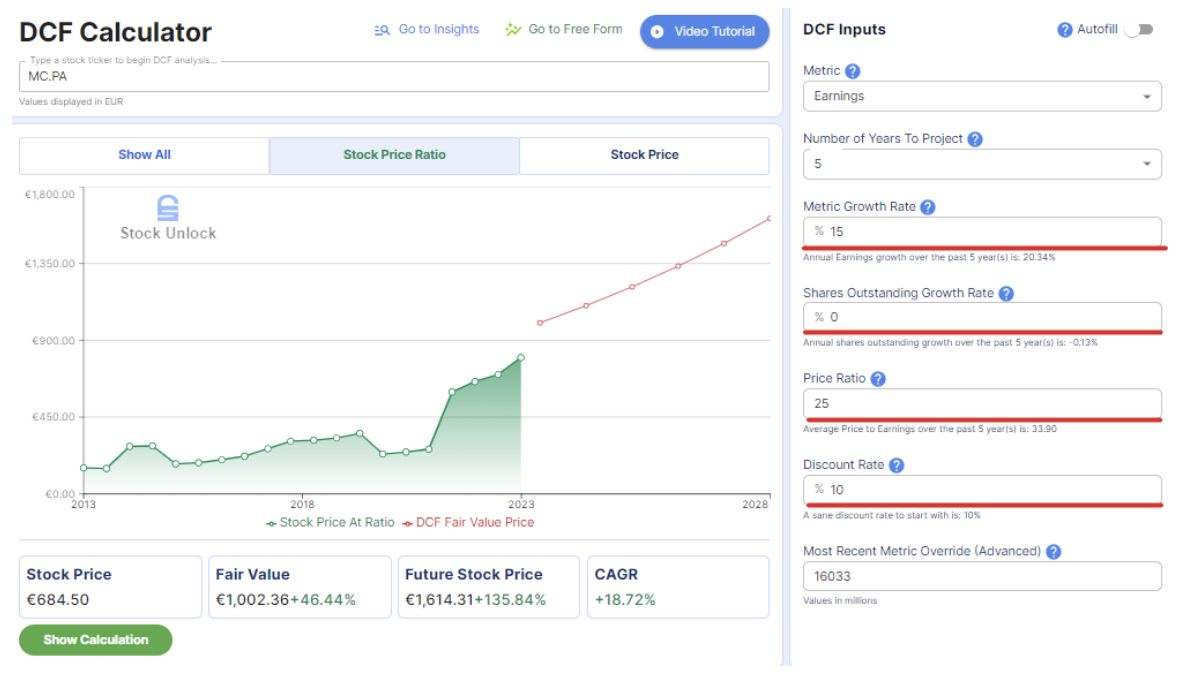

Using Stock Unlock’s DCF Tool, LVMH’s current valuation of about 22x earnings looks fairly attractive if you believe its growth prospects will continue. With the following assumptions, we get a compound annual growth rate of ~19%:

15% earnings growth over the next 5 years

Shares outstanding to remain flat

A 25x P/E-ratio at the end of year 5

A 10% discount rate

Investors would have to believe that demand for LVMH’s brands will continue to grow over the next 5 years for earnings to compound at 15%. For the record, EPS has grown at 17% annually over the past decade, but that includes 2021 and 2022 when people had a lot of discretionary income during lockdowns and interest rates were close to zero. The ability to grow earnings will also depend on demand from China and emerging markets to remain strong.

Further, investors would also have to be comfortable with LVMH’s strategy to acquire other brands and successfully run these while continuing to organically grow the brands that already exist in the portfolio. This is mostly a bet on Bernard Arnault.

In fact, the Arnault family group owns 48.2% of LVMH and 63.9% of voting rights, which means that the company will likely be run by the Arnault family for a long time. Skin in the game is usually a positive sign because management’s interests are aligned with shareholders, but it is nonetheless important to remember that LVMH is Bernard Arnault’s darling and he will continue to run it with his ruthless leadership acumen.

Conclusion

-

LVMH has an outstanding history of successful M&A and a decentralized structure that allows each of the 75 brands to operate independently

-

Strong moat and pricing power, especially world-famous luxury brands like Louis Vuitton and Dior

-

Founder-led and family-owned. Bernard Arnault is arguably the best possible steward of the brands in the LVMH group and having a large portion of his net worth tied up in the company ensures that his interests are aligned with shareholders

-

A larger portion of LVMH’s growth is likely to come from China and other emerging markets in the future. That could mean more volatility as well as geopolitical risk associated with doing business between North America, Europe and Asia

-

LVMH looks like a world class brand with an incredible track record. However, its price today does seem to be factoring in continued strong future growth. This could be a high-quality stock to add to a watchlist or investigate further.

![]()

![]()

C’est clair que BA est un investisseur hors pair.

Mais tu vois ces temps-ci, je regarde aussi pas mal du côté de RMS, qui est à l’opposé du spectre, avec une croissance organique vs les M&A de lvmh ?

Mekekidi ![]()

Haha yes j’ai vu ça, « la french touch » ![]()

il m’ a l’air quand meme tres optimiste leur DCF avec la situation actuelle !

j’aurais plutot pris 10% en hypothese standard et 15% en optimiste.